Don’t be caught with your account balance down

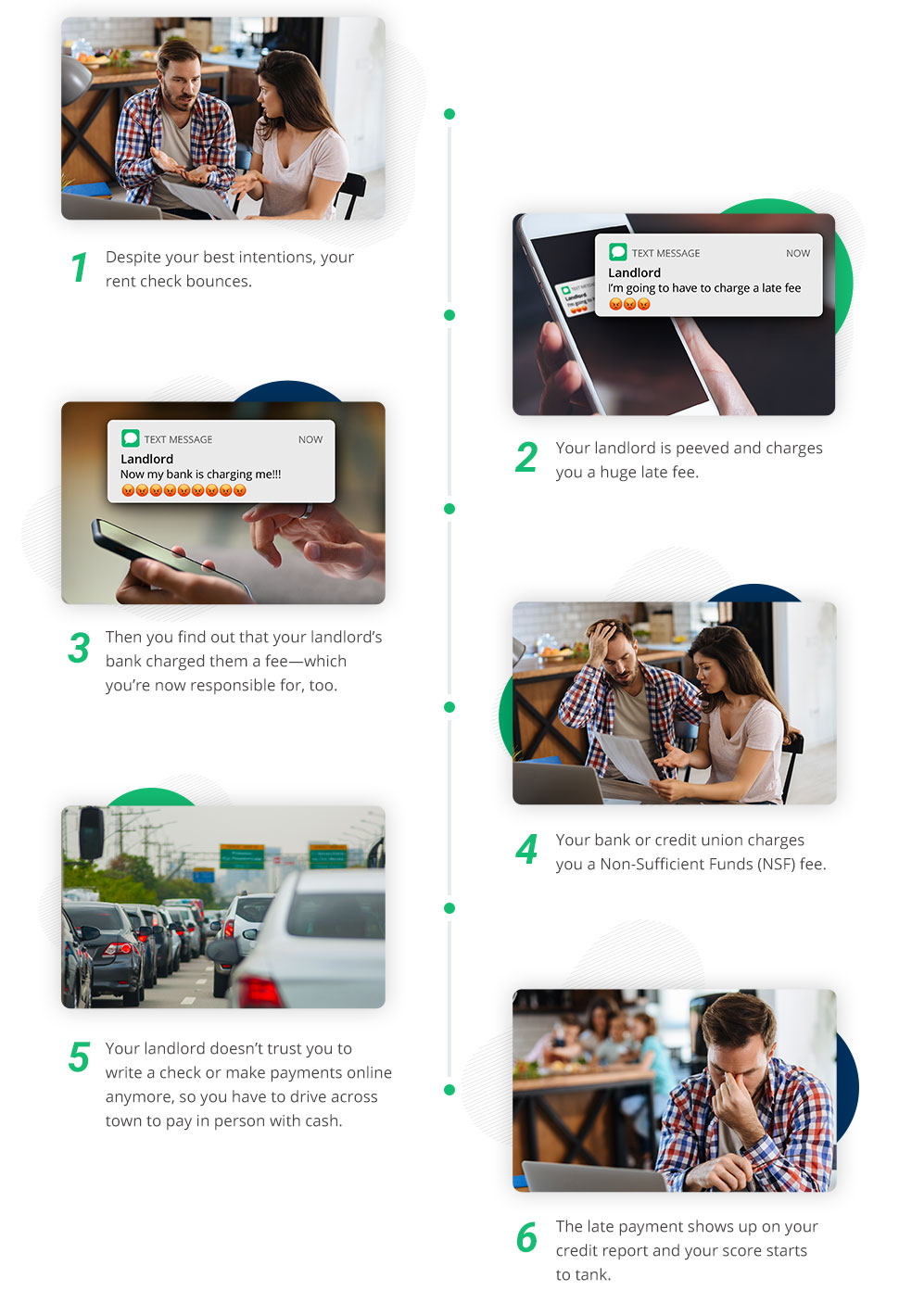

The Ripple Effect

Try as you might, it can be hard to keep track of every expense you have – whether it’s your monthly bills or your daily necessities. Not to mention the deposit you made yesterday still isn’t showing up in your account. Sometimes the timing is just off and you end up bouncing an important payment, like your rent. This simple mistake creates an exhausting amount of consequences that are all completely out of your control.

Everyone deserves a second chance.

If you had known that bouncing a payment would cause so much trouble, wouldn’t you have done something about it? DoubleCheck gives you a second chance. Here’s how.

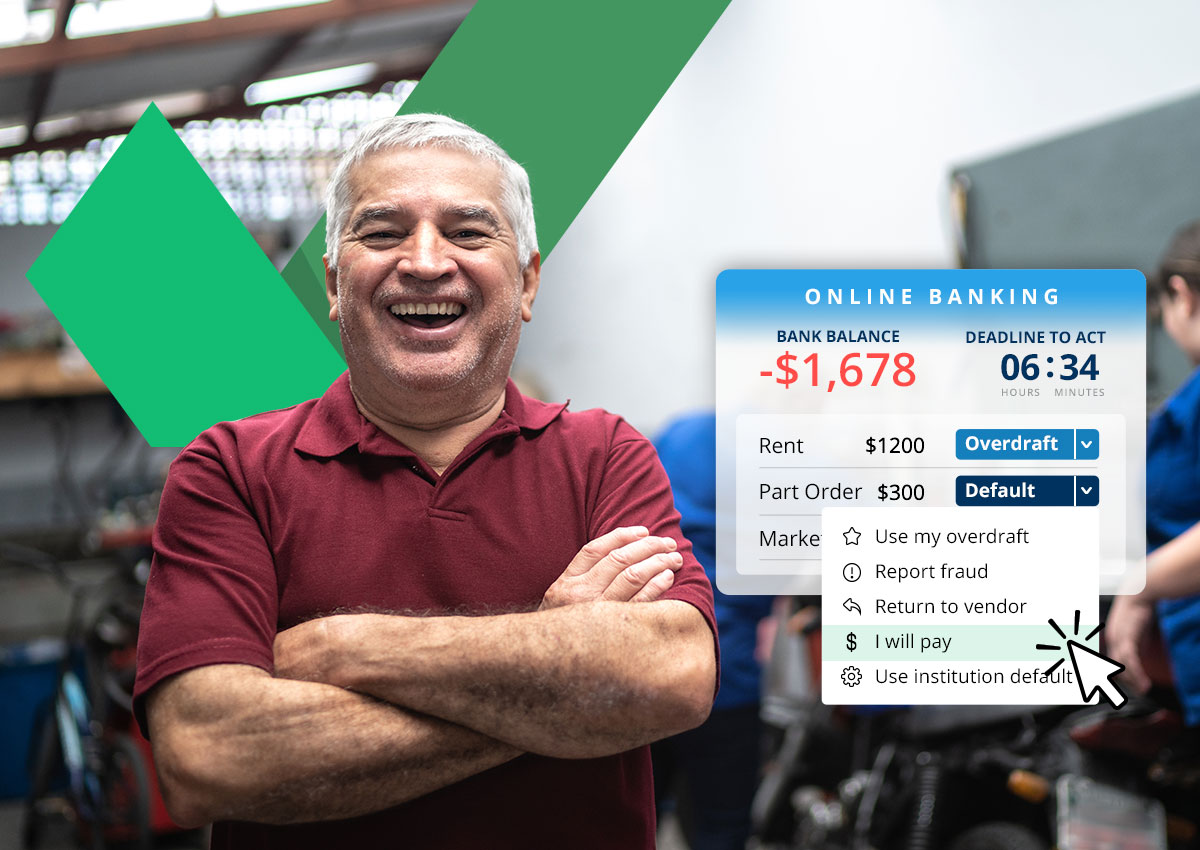

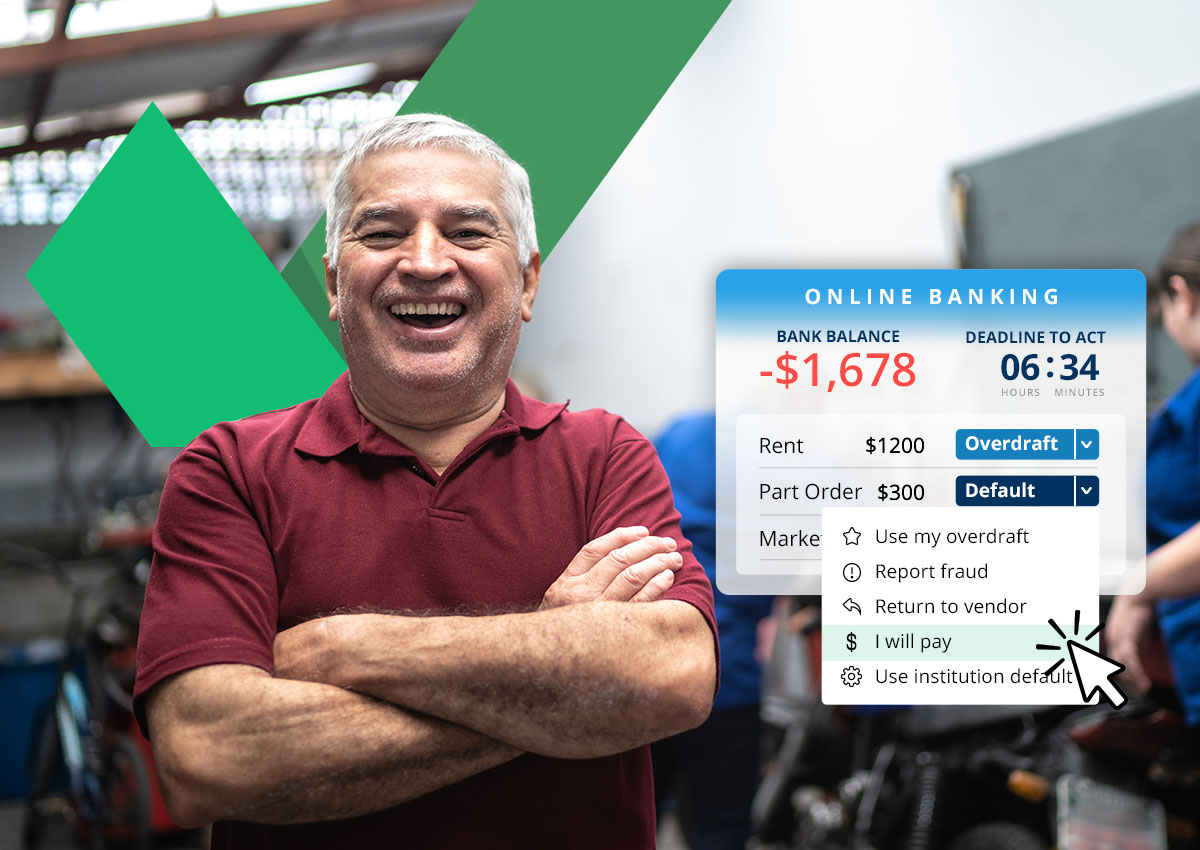

Just log in. We’ll lay

out your options.

You’ll receive a text and email when your account is overdrawn and you’re about to bounce a payment. Just use your existing banking credentials to log in and review the options for every transaction with insufficient funds. You’ll see which payments are about to bounce and how long you have to address your shortage.

Override your

bank’s decisions

Your bank usually decides who gets paid when you’re short in your account, but DoubleCheck allows you to change those decisions. You can prioritize what to pay so critical bills, like rent or utilities, get paid without incurring additional late fees or returned check fees.

Make a plan for

your payments

If you have overdraft funds available, you can choose exactly how you want to apply it and what items to return if there’s not enough to cover all your expenses. But if you don’t, there’s no reason to worry, you’re still in control. Keep scrolling to learn about all of the payment options you get with DoubleCheck.

Add funds, fast

If you don’t have overdraft funds available, or you don’t want to use them, you have plenty of options:

Cover it with cash

Move some money around

Pay with an app

Charge it

Report fraud on the spot

If the transaction that caused your account shortage is fraudulent, you can stop the payment and prevent it from causing legitimate transactions to bounce.

Want DoubleCheck at your bank?

Why DoubleCheck?

Because bouncing a payment sticks with you like a bad hangover.

Stop the running train of late fees

Keep your reputation intact

Kick credit hits to the curb

Breathe easy because you’re in control of your payments

You won’t even need to think of a new password

Are you a small business?

Small businesses are the heartbeat of America

But making payroll can often be a heart stopping moment. Cash really matters every day, moment to moment because small businesses live from invoice to incoming payments. DoubleCheck is there to make sure you never miss a payment.

With DoubleCheck, you can manage your cash the way you want to — without the high fees.

No bank knows your business and relationships like you do. Timing of payments and fees are often out of your control, but now some of that control can shift back to you.

Cashflow tools

Get your discount

Alert system

Avoid late fees

Ready to get started?

Check out who’s already using DoubleCheck.